Simplifying the

tax year end puzzle

Our hub contains the key information you need to make tax year end as straightforward as possible. Here you’ll find the important dates and deadlines, essential declarations and applications you need to help your clients get tax year end ready.

The new Nucleus platform - a new era for you and your clients

As we approach the end of another tax year, it’s an ideal time to review the tax planning opportunities available to your clients and make sure they're making full use of their allowances, exemptions, and available reliefs. Many allowances and exemptions remain frozen, so this continues to be a key aspect of planning.

Treasury tax receipts are expected to rise further in the coming years due to a combination of frozen personal tax allowances, nil rate bands and tax rates, reductions in the capital gains tax exemption and dividend allowances and rising average earnings. As a result, more individuals than ever are paying tax, often at higher rates.

When combined with imminent changes to agricultural and business relief, the inclusion of pensions within the inheritance tax framework from 2027, and potential changes to the ISA framework, the importance of advice has never been greater. The tax year end provides an ideal opportunity to review clients’ holistic financial plans and ensure investments are structured in the most tax-efficient way for their individual circumstances.

Countdown to tax year end

Illuminate Technical: Technical support for you and your clients

Illuminate Technical hosts a wealth of knowledge from our Technical Support team to help you through tax year end including:

- Technical factsheets - detailed analysis on a range of useful topics including Pensions, ISAs, Trusts and more

- Tech Talks - focused articles on key industry topics

- Tech News - articles in the industry press written on matters affecting you and your clients

New year, new rules... time to get planning

Listen on demand to our webinar with technical manager Julia Peake as she discusses the myriad of changes approaching in the new tax year and what you need to know to help your clients’ meet their financial goals.

Get a head start on the new tax year

This handy Tech Talk looks at the key changes coming on 6 April 2026 and the opportunities this brings for you and your clients.

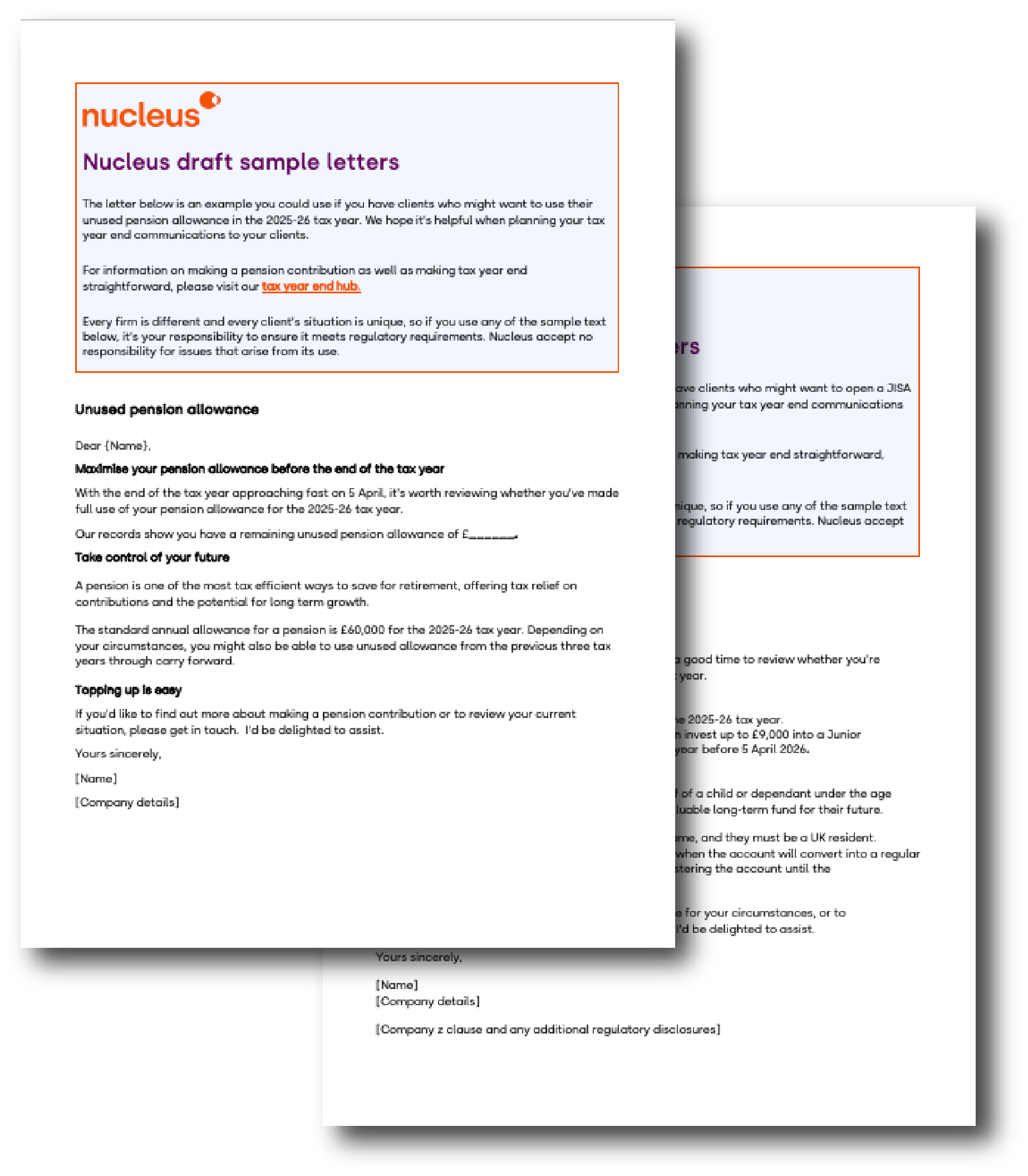

Help with your tax year end communications

Do you have clients with remaining allowances? Our sample letters can help you contact clients and encourage them to take advantage before it’s too late. Simply populate with your company and client information and contact them in your usual way.